Abracadabra

Founding Member

Posts : 1325 Posts : 1325

Join date : 2010-05-13

Age : 81

|  Subject: Comparing the FairTax with the Flat tax and the Current US Tax Code Subject: Comparing the FairTax with the Flat tax and the Current US Tax Code  Fri 23 Sep 2011, 10:15 am Fri 23 Sep 2011, 10:15 am | |

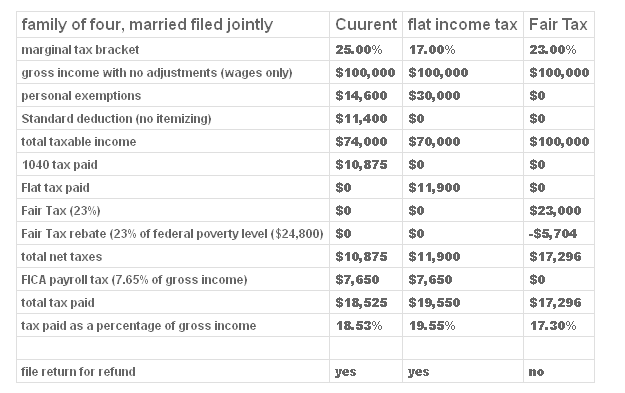

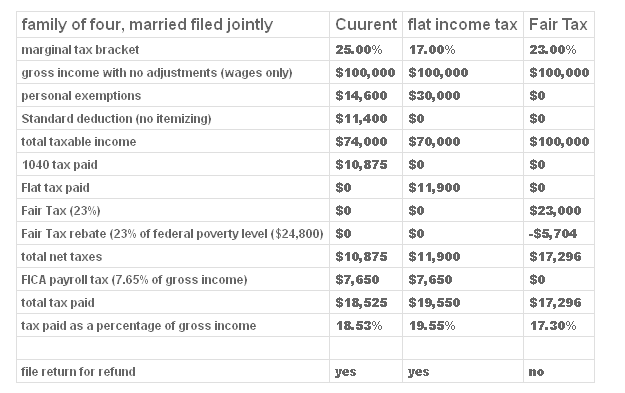

| I originally ran this post on my blog at The Baxter Bulletin (Mountain Home, AR) on March 7, 2009...I used the 2008 US Tax Code as the basis for my calculations: Here's a chart I compiled to contrast how the Fair Tax, a broadbased consumption tax [with a universal rebate on taxes paid on the value of goods and services equal to the federal poverty level] stacks up against the current income tax code and the so-called "f;at tax" that has been supported by Steve Forbes. For this comparison, we're going to use a family of four [two adults, two kids] making $100,000 a year. To keep things simple, we'll assume that the family does not itemize their return, and that their total income does not include any interest, dividends, and/or capital gains. Also, I will also presume that the amount of payroll tax withheld equals the amount of tax paid.  As you can see, the Fair Tax differs from the other two systems in the way that taxes are collected. Even though the "flat tax" has similar provisions for a personal exemption as the current tax system, it still has the withholding tax method on payroll and FICA. The current system and the flat tax still require that people file a tax return in order to get a refund. The fair Tax, on the other hand, does not have any withholding taxes...the tax is paid at the final retail point of sale; therefore, the family has all of their take home pay from the start. The universal rebate built into the Fair Tax is paid out monthly, which means the family will get a check every month of $475.33 in addition to initially keeping their entire take home pay. So, as you can see by this example, the Fair Tax puts more cash in your pocket right from the start, and you don't have to worry about filing a return to get your money back that was initially withheld. Even though the Fair Tax rate is almost as high as the current marginal tax rate charged at $100,000, the taxes paid as a percentage of total income is actually LOWER under the Fair Tax. |

|